NEW DELHI, Feb 13: India’s vegetable oil imports fell 2 per cent to 3.96 million tonnes in the first quarter of the 2025-26 oil year (November-October) from a year earlier, as lower soybean and sunflower oil purchases offset a rise in palm oil imports, industry data showed on Friday.

The world’s biggest vegetable oil importer bought 4.05 million tonnes, including edible and non-edible oils, in the same period a year ago, according to the Solvent Extractors Association of India (SEA).

Palm oil imports rose 18 per cent to 1.91 million tonnes in the November 2025-January 2026 quarter from 1.62 million tonnes a year earlier, the industry body said in a statement.

Port stocks of palm oil stood at 4,86,000 tonnes on February 1, up 33,000 tonnes from the previous month.

Crude soybean oil imports fell 9 per cent to 1.20 million tonnes from 1.27 million tonnes, while port stocks declined to 1,90,000 tonnes from 3,00,000 tonnes a month earlier.

Crude sunflower oil imports dropped 15 per cent to 7,59,000 tonnes from 8,94,000 tonnes, with port stocks at 1,85,000 tonnes compared with 2,00,000 tonnes in the previous month.

Nepal exported about 54,000 tonnes of refined oils to India in November 2025, consisting mainly of 47,639 tonnes of refined soya oil, 3,022 tonnes of refined sunflower oil and 2,484 tonnes of RBD palmolein. In December 2025, Nepal shipped about 48,000 tonnes of refined oils, primarily refined soybean oil.

Total edible oil stocks at Indian ports stood at 8,64,000 tonnes on February 1, while pipeline stock considering domestic production and consumption was at 8,85,000 tonnes. Total stock was 1.75 million tonnes, unchanged from January 1, due to higher imports in January.

Indonesia and Malaysia are the major suppliers of palm oil to India. (PTI)

AgWeb’s Tyne Morgan reported that “the U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty, and eroding trust in data have pushed many producers from planning for profitability into fighting for survival. Economists largely view the downturn as cyclical and manageable through optimization, while farmers experience it as a structural stress test on their operations and livelihoods.”

In the first Farm Journal Ag Economists’ Monthly Monitor of 2026, economists “pointed to a familiar but intensifying split in the ag economy: strength in livestock, particularly beef cattle, versus persistent financial stress across much of the row-crop sector,” Morgan reported. “Tight cattle supplies and strong global demand for animal protein continue to support profitability in the livestock sector, even as economists warn that future prospects remain uncertain. At the same time, global surpluses of corn, soybeans, and wheat, combined with weak export demand for certain commodities, are weighing heavily on crop prices.”

“Across nearly all responses, margin pressure emerged as a dominant concern,” Morgan reported. “Elevated input costs, rising interest rates, and tightening access to operating loans are pushing break-even costs above market prices for many producers, especially in grain production.”

“When asked a simple but heavy question: ‘What can you do to be successful in 2026,’ farmers didn’t sugarcoat the challenge. Their answers reflect pressure, fatigue, and uncertainty. But underneath the blunt language is a clear, consistent strategy emerging across operations: protect cash, defend ROI and stay flexible long enough to outlast the cycle,” Morgan reported. “While several producers said they’re looking to diversify as a key to success, the most dominant theme was cutting costs to the bone, especially when it comes to capital spending. Farmers repeatedly emphasized zero, or near-zero, capex, delaying equipment upgrades and scrutinizing every purchase.”

12 February 2026, New Delhi: Global edible oil markets are entering a phase of structural volatility driven by trade realignments, tightening supply growth, and expanding biofuel mandates, according to Mr. Sudhakar Desai, President of the Indian Vegetable Oil Producers’ Association (IVPA) and CEO of Emami Agrotech Ltd.

Addressing the UOB Kay Hian Conference in Kuala Lumpur on the theme “Navigating Structural Shifts in Global Edible Oils: Implications for India,” Mr. Desai highlighted that geopolitical restructuring and policy changes are reshaping global trade flows, compressing arbitrage opportunities, and increasing price sensitivity across the supply chain.

He noted that even minor adjustments in import duties, biofuel mandates, or trade flows are now triggering disproportionate price swings in edible oil markets, amplifying the impact of energy prices, currency fluctuations, and policy decisions.

Global Supply Outlook and Price Pressures

Mr. Desai said global production of the four major vegetable oils is projected to reach 208.4 million tonnes in the 2025–26 marketing year, reflecting only marginal growth compared to the previous year. While palm and rapeseed oil output is expected to rise, sunflower oil production remains constrained, keeping global supply balances vulnerable to weather-related disruptions and policy shifts.

The limited expansion in supply is expected to intensify competition among major oils and maintain volatile price spreads. Sunflower oil, in particular, is likely to continue commanding a premium in international markets.

Biofuel mandates are emerging as a key market driver. Indonesia’s biodiesel programme currently absorbs around 14 million tonnes of palm oil annually, while U.S. biofuel policies continue to support soybean oil demand and price expectations.

According to Mr. Desai, edible oils are increasingly functioning as energy-linked strategic commodities rather than purely food-based products. This structural shift is raising the price floor and strengthening correlations with crude oil trends and government policy cycles.

The lecithin market is gaining considerable traction as it responds to evolving consumer preferences and industry advancements. With increasing demand across various sectors, this market is poised for significant expansion in the coming years. Let's explore the current market size, key players, influential trends, and detailed segment analysis to understand the landscape better.

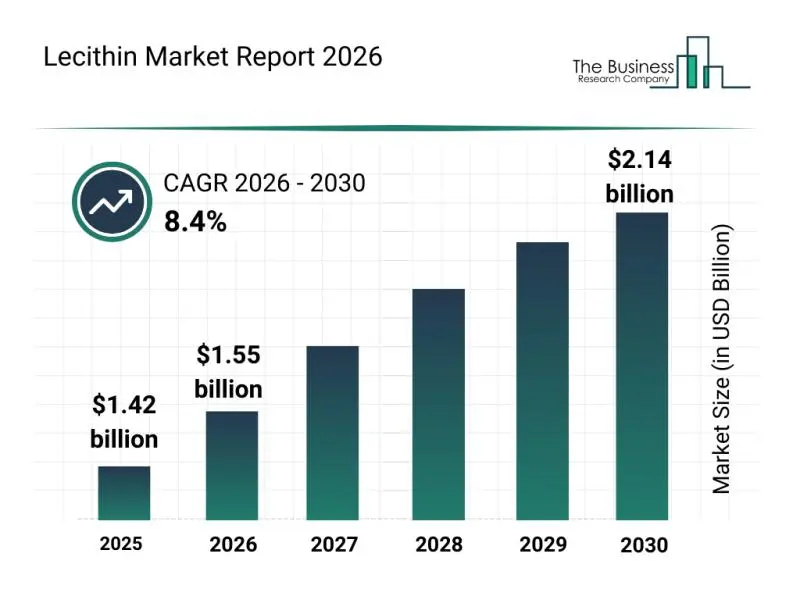

Projected Growth and Size of the Lecithin Market by 2030

The global lecithin market is set for strong growth, expected to reach a value of $2.14 billion by 2030. This expansion corresponds to a compound annual growth rate (CAGR) of 8.4%. Several factors are driving this upward trend, including the rising popularity of plant-based foods, increased demand for hypoallergenic ingredients, growth in dietary supplement* consumption, ongoing innovations in lecithin processing technologies, and stricter clean label regulations. Key market trends anticipated during the forecast period involve a higher demand for clean label emulsifiers, wider adoption of non-GMO lecithin, growth in sunflower-derived lecithin production, rising use in nutraceuticals, and a growing focus on functional food ingredients.

The global vegetable oil market this week was under pressure: palm oil on Bursa Malaysia was declining, soybean oil on CBOT remained volatile, shaping a restrained external background. This was reported by SPIKE BROKERS, as cited by agronews.ua.

At the same time, sunflower oil appeared relatively stable – FOB Northern Europe is holding in the range of $1460-1465 for March-April, with local strengthening in certain supply periods.

Sunflower oil in the European Union maintains a premium over soybean and palm oil, while growth in the soy complex is limited by palm weakness and high global stocks. This forms a neutral external background without sharp price impulses and does not create room for significant price increases.

According to Oil World, in January, Argentina reduced exports of soybean oil compared to December from 562 to 460-480 thousand tons (502 thousand tons in January 2025), and soybean meal - from 2.05 to 1.95-2 (2.22) million tons.

This is due to a decrease in soybean processing volumes in the country, which will continue to decline in February.

At the same time, exports of sunflower oil in January increased compared to the corresponding figure in 2025 by two times to 100 thousand tons, sunflower meal - from 105 to 150-160 thousand tons, and exports of sunflower seeds reached almost 100 thousand tons (with deliveries to South Africa and the Black Sea countries) and will continue to increase in February.

Sunflower processing in Argentina seasonally increases in February-March, and this year will peak in April, when new processing facilities will be put into operation. Accordingly, exports of sunflower oil and meal will increase in the coming months.

Currently, sunflower has been harvested on 25% of the country's area, and the harvest could reach a record 6.2-6.6 million tons (compared to 5.5 million tons in 2025 and 4.5 million tons in 2024).

Scientists Turn Sunflower Oil Waste into a Powerful Bread Upgrade, Boosting Nutrition and Sustainability

In a groundbreaking stride towards sustainable food systems and enhanced nutrition, scientists have uncovered an innovative way to repurpose the byproduct of sunflower oil production into a valuable food ingredient that could revolutionize the bread industry. This dual-purpose innovation addresses both the pervasive issue of agricultural waste and significantly elevates the nutritional profile of one of the world's most consumed staple foods.

Traditionally, the solid residue left after extracting sunflower oil, known as defatted sunflower meal, is either discarded or utilized as low-value animal feed. However, recent research has unveiled the immense potential of this meal when properly processed into partially defatted sunflower seed flour. Studies indicate that by replacing a portion of wheat flour with this novel ingredient, ordinary bread can be transformed into a powerhouse of protein, fiber, and antioxidants, offering additional health advantages related to blood sugar management and improved fat digestion.

From Waste to Wholesome: A Sustainable Innovation

The global sunflower oil industry is a massive operation, generating substantial quantities of solid waste. This byproduct, often rich in protein and fiber but largely undervalued economically, presents both an environmental challenge and a missed opportunity. Research and development efforts have increasingly focused on finding innovative ways to valorize such waste streams, transforming them into high-value products. This new discovery offers a clear pathway to achieving this, by converting sunflower meal into a human-grade flour.

The significance of this innovation lies in its capacity to address multiple pressing issues. Firstly, it contributes to reducing food waste and agricultural byproducts, aligning with global sustainable development goals. Secondly, it provides a novel and sustainable source of...

In the first days of February 2026, active changes in prices are observed on the sunflower market. For now, delivering a ton of production on the terms of delivery to the destination port costs $689 – $4 more than a week ago. This information is reported by Spike Brokers analysts.

The price increase started simultaneously with the strengthening of internal demand for raw materials from leading processors. They are currently actively entering into contracts for February. As a result of January, only 6 thousand tons of seeds were exported from Ukraine abroad in 29 days. The reason is active internal consumption and favorable processing prices.

Direct export of seeds is minimal, as about 97% of the harvest is processed within the country. In the first four months of the 2025/26 season, seed exports amounted to only 12 thousand tons, the lowest figure in the last 20 years.

Since January 1, 2026, the export duty on sunflower to the EU has been abolished, which increases competition between exporters and local plants. In 2024, Ukraine ranked 1st in the world in oil exports, accounting for 36.8% of the world market ($5.12 billion). In the first half of 2025, 2.4 million tons of oil were exported for $2.77 billion.

Main sales markets (2024-2025):

– EU (especially Spain and Italy) – 56%;

– India – 14%;

– Turkey, China, Egypt.

China remains the main importer of Ukrainian meal: about 671 thousand tons were shipped there from September to December of the 2025/26 season. In the EU, there is competition from cheaper products from Argentina and Canada. The pace of exports is influenced by shelling of port infrastructure, rising energy prices, and logistical difficulties.

Sunflower remains a key and most profitable agricultural crop for Ukraine. In 2024, about 4.9 million hectares were allocated for sunflower, which is 6.3% less than the previous year. Kirovohrad region ranks first in Ukraine in terms of sunflower cultivation areas.